How I Protect My Wealth While Building Financial Freedom – Real Strategies That Work

What if the biggest threat to your financial freedom isn’t earning too little—but losing what you already have? I learned this the hard way after nearly wiping out years of progress. Protecting assets isn’t just for the rich; it’s the quiet foundation of lasting wealth. In this article, I’ll walk you through the real, tested strategies I use to grow and shield my money, because true financial freedom means sleeping well at night, no matter what the market does. This isn’t about chasing get-rich-quick schemes or speculative bets. It’s about building a resilient financial life—one where growth and protection go hand in hand. For anyone raising a family, managing a household, or planning for the future, peace of mind is priceless. And that begins not with more income, but with smarter protection of what you’ve already earned.

The Hidden Risk No One Talks About

Most financial advice focuses on earning more—higher salaries, better investments, side hustles. But few emphasize the silent danger that can undo all that effort: the risk of losing what you’ve already built. This is the hidden cost of financial progress, often overlooked until it’s too late. For many, especially women in their 30s to 50s managing family budgets and long-term goals, preserving capital isn’t a luxury—it’s a necessity. The truth is, wealth accumulation isn’t just about growth; it’s equally about avoiding major setbacks that can derail years of careful planning.

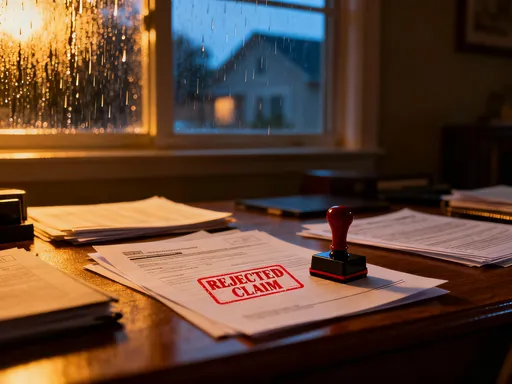

I once believed that if I invested wisely, market ups and downs would balance out over time. Then came a sharp correction that erased nearly 25% of my portfolio in just a few months. I hadn’t done anything wrong—no bad investments, no emotional trades—but I still lost ground. That experience was a wake-up call. I realized that without a deliberate strategy to protect my assets, even strong long-term performance could be undermined by short-term volatility. The real risk wasn’t poor returns; it was the emotional and financial toll of watching hard-earned savings shrink, especially when life circumstances—like a child’s education or a home renovation—made liquidity essential.

The psychological aspect of this risk is often underestimated. When markets fall, fear takes over. People sell low, miss the recovery, and struggle to re-enter at higher prices. This behavior isn’t irrational—it’s human. But it’s also preventable with the right mindset and safeguards. The shift I made was subtle but powerful: I stopped viewing protection as a drag on performance and started seeing it as the foundation of sustainable growth. Just as a house needs a strong foundation before you add floors, your financial life needs resilience before you aim for aggressive returns.

This mindset change also involves recognizing that financial freedom isn’t just about reaching a number in your bank account. It’s about having control—over your choices, your time, and your peace of mind. When you protect your wealth, you reduce dependency on market timing and emotional decision-making. You create space to make thoughtful choices rather than reactive ones. For busy mothers and caregivers, this kind of stability is invaluable. It means not having to worry about whether a market dip will delay a family vacation, affect college savings, or compromise retirement plans. True security comes not from chasing every opportunity, but from building a buffer against the inevitable downturns.

Diversification: More Than Just Spreading Money Around

Diversification is one of the most commonly cited principles in personal finance, yet it’s also one of the most misunderstood. Many people believe they’re diversified simply because they own multiple funds or stocks. But true diversification goes beyond quantity—it’s about quality of exposure and the relationships between different asset classes. I made this mistake early on, thinking that holding three different stock mutual funds across tech, healthcare, and consumer goods was enough. When the broader market declined, all three dropped together. I learned the hard way that diversification within a single asset class—like equities—doesn’t provide real protection when systemic risk hits.

Real diversification means owning assets that respond differently to the same economic events. For example, when stock markets fall due to rising interest rates, bonds—especially government-issued ones—often hold steady or even rise in value. Real estate may behave differently still, influenced more by local supply and demand than global market sentiment. Cash reserves remain stable and provide immediate liquidity. The goal is to build a portfolio where not everything moves in the same direction at the same time. This doesn’t eliminate risk, but it smooths out volatility, which is critical for long-term investors who can’t afford to sell at a loss.

One of the most effective ways to achieve this is through asset allocation based on your risk tolerance, time horizon, and financial goals. For someone in her 40s with children approaching college age, a balanced mix of 60% equities, 30% fixed income, and 10% in cash or alternatives might make sense. As retirement nears, shifting toward more conservative holdings helps preserve capital. The key is not to chase past performance but to understand how each asset class behaves under different conditions. Historical data shows that over decades, diversified portfolios tend to deliver more consistent returns with less dramatic drawdowns than concentrated ones.

Another overlooked aspect of diversification is geographic exposure. Keeping all investments in domestic markets limits your resilience to local economic shocks. International stocks and bonds introduce exposure to different growth cycles, currencies, and policy environments. While global investing carries its own risks—like currency fluctuations and political instability—it also offers opportunities for gains when one region outperforms another. The goal isn’t to predict which country will lead next, but to avoid putting all your eggs in one national basket. Exchange-traded funds (ETFs) that track broad international indexes offer an accessible way to add this layer without requiring deep expertise.

Emergency Funds as Financial Shock Absorbers

An emergency fund is often described as a safety net for job loss or medical bills, but its role in wealth protection is far broader. It acts as a financial shock absorber, preventing you from making costly decisions during times of stress. I learned this firsthand when a major plumbing issue forced an unexpected $5,000 repair. Without an emergency fund, I would have had to sell investments at a market low or take on high-interest debt. Instead, I used liquid savings and avoided both emotional and financial strain. That experience showed me that an emergency fund isn’t just about covering emergencies—it’s about protecting your long-term strategy from short-term disruptions.

For families, this buffer is especially important. Life is unpredictable: cars break down, children need orthodontics, parents may require unexpected care. When these events happen, having accessible cash means you don’t have to compromise your investment timeline. Selling stocks after a market drop locks in losses and delays compounding. Borrowing at high interest adds long-term cost. An emergency fund removes the pressure to choose between financial health and immediate needs. It’s not an investment—it’s insurance against forced decisions.

So how much should you keep? A common guideline is three to six months of essential living expenses. But this isn’t one-size-fits-all. If your income is stable and you have multiple earners in the household, three months might suffice. If you’re a single parent or rely on freelance work, six to twelve months may be more appropriate. The key is to calculate your non-negotiable expenses—rent or mortgage, utilities, groceries, insurance, transportation—and ensure your fund covers those for the chosen period. This number should be revisited annually or after major life changes like a new child or a career shift.

Where you keep this money matters just as much as how much you save. It should be in a safe, liquid account—like a high-yield savings account or money market fund—where it earns some interest without being exposed to market risk. Avoid locking it in certificates of deposit with early withdrawal penalties or investing it in volatile assets. Accessibility is crucial: you should be able to access the funds within a day or two if needed. At the same time, consider keeping it in a separate account from your daily spending to reduce the temptation to dip into it for non-emergencies. Automation helps—setting up a direct deposit into your emergency fund each payday makes saving consistent and painless.

Insurance: The Silent Guardian of Wealth

Insurance is one of the most powerful yet underappreciated tools for wealth preservation. Many people view it as an unnecessary expense—something to cut when budgets are tight. But this mindset can be dangerously short-sighted. A single unexpected event—a serious illness, a car accident, or a house fire—can erase years of saving in moments. I used to think I didn’t need long-term care insurance because I was healthy and active. Then a close friend suffered a stroke in her early 50s. Her recovery required months of rehabilitation, and without coverage, the costs drained her savings. That was a sobering reminder: health isn’t a guarantee, and neither is financial security without proper protection.

The right insurance policies act as a firewall, shielding your assets from catastrophic loss. Health insurance, of course, is essential, but beyond that, several types of coverage play a critical role. Disability insurance replaces income if you’re unable to work due to illness or injury—something many overlook despite the fact that the odds of a working-age adult experiencing a disabling condition are higher than the odds of dying prematurely. Life insurance, particularly for parents, ensures dependents are financially protected. Home and auto insurance prevent asset depletion from property damage. And umbrella liability coverage provides an extra layer of defense against lawsuits that could target your savings or home equity.

Not all insurance is equally valuable, however. Some products—like whole life insurance with high fees or supplemental policies with limited benefits—can be more costly than helpful. The key is to assess your real risks and choose coverage that aligns with your financial picture. For example, if you have significant savings and no dependents, life insurance may be less critical. If you own a home, property insurance is non-negotiable. A financial advisor or insurance professional can help evaluate your exposure and recommend appropriate policies without overselling unnecessary products.

Think of insurance not as a cost, but as a strategic investment in stability. The premiums you pay are small compared to the potential losses they prevent. Just as you wouldn’t drive a car without insurance, you shouldn’t grow wealth without safeguarding it. For women managing household finances, this layer of protection brings peace of mind—not just for themselves, but for their families. Knowing that a crisis won’t devastate your financial future allows you to focus on long-term goals with confidence.

Avoiding Lifestyle Inflation After Gains

One of the most insidious threats to financial freedom isn’t market risk or poor investment choices—it’s lifestyle inflation. This is the tendency to increase spending in line with income or portfolio gains, often without realizing it. When my investments performed well one year, I felt a surge of confidence. I considered upgrading my car, taking a more expensive vacation, or moving to a larger apartment. Nothing was reckless, but each decision would have added recurring costs. I paused and asked myself: Was I rewarding myself, or undermining my future security? That moment of reflection saved me from a common trap—one that quietly erodes wealth even when everything seems to be going well.

Lifestyle inflation is especially dangerous because it feels harmless. Buying a slightly bigger house, dining out more often, or enrolling kids in premium activities doesn’t feel like overspending when you’re earning more or seeing portfolio growth. But these small increases compound over time, raising your baseline expenses and making it harder to save or withstand income disruptions. The result? You may earn more, but your financial flexibility doesn’t improve. In fact, you become more vulnerable, because now you need higher income just to maintain your standard of living.

The solution isn’t to live frugally or deny yourself joy. It’s to celebrate wins wisely. Instead of spending investment gains, consider redirecting them into additional savings, debt reduction, or future goals like education or travel funds. If you do want to treat yourself, choose one-time experiences over recurring expenses. A special family trip can create lasting memories without adding monthly bills. Upgrading your wardrobe or kitchen is fine—but only if it doesn’t stretch your budget or delay other priorities.

Developing this discipline requires a shift in mindset. Instead of measuring success by what you consume, measure it by what you preserve and grow. The most financially secure people aren’t always the highest earners—they’re the ones who live below their means and protect their gains. For women balancing family needs with personal goals, this balance is essential. It allows you to provide for your household while still building a legacy. By resisting the urge to inflate your lifestyle after every win, you maintain control over your financial destiny and stay on track toward lasting freedom.

Tax Efficiency: Keeping More of What You Earn

Taxes are one of the largest expenses most people will ever face—and one of the most controllable. Yet many investors overlook tax efficiency, focusing only on pre-tax returns. I used to do the same, thrilled by a 10% gain without realizing that capital gains taxes would take a significant portion. Over time, I learned that how you invest matters as much as what you invest in. Tax-efficient strategies don’t eliminate taxes, but they can significantly reduce the drag on your portfolio’s growth, allowing more money to compound over the long term.

One of the most effective tools is using the right account types. Retirement accounts like 401(k)s and IRAs offer tax advantages—either upfront deductions or tax-free growth—that can boost long-term results. Contributing the maximum allowed, especially with employer matching, is one of the simplest ways to enhance returns. Beyond retirement accounts, taxable brokerage accounts can still be managed tax-efficiently. For example, holding investments for more than a year qualifies you for lower long-term capital gains rates. Selling winners strategically—such as those with minimal gains—can also minimize tax impact.

Another strategy is asset location: placing tax-inefficient investments, like bond funds or real estate investment trusts (REITs), in tax-advantaged accounts, while keeping tax-efficient assets like index funds in taxable accounts. This small adjustment can improve after-tax returns without changing your overall risk profile. Additionally, tax-loss harvesting—selling losing positions to offset gains—can reduce your tax bill while maintaining portfolio balance. These aren’t aggressive tax avoidance tactics; they’re legitimate strategies used by financial professionals to enhance net returns.

The compounding effect of tax efficiency is profound. Even a 1-2% reduction in annual tax drag can result in hundreds of thousands of dollars in additional wealth over decades. For someone in her 40s investing consistently, this could mean the difference between retiring comfortably or needing to work longer. The goal isn’t to avoid taxes illegally, but to pay only what’s necessary and keep more of what you’ve earned. In a world where every dollar counts, tax-smart investing is a quiet but powerful ally in building lasting financial security.

The Long Game: Why Patience Beats Performance

In a world obsessed with quick results, the most powerful financial strategy is also the most underrated: patience. I’ve tested aggressive trading, chased hot stocks, and experimented with market timing. Every time, I came back to the same truth—consistent, disciplined investing outperforms even the most brilliant short-term moves. The real wealth builders aren’t those who pick the next big winner; they’re the ones who stay the course, rebalance when needed, and avoid panic selling during downturns. This isn’t exciting or flashy, but it’s effective. And for women focused on family, stability, and long-term well-being, it’s the only approach that truly delivers peace of mind.

Markets are unpredictable in the short term but remarkably reliable over decades. Historical data shows that staying invested through volatility yields better results than trying to time the market. Missing just a few of the best-performing days can drastically reduce long-term returns. That’s why emotional discipline is as important as financial knowledge. When headlines scream crisis and your portfolio dips, the instinct is to act. But often, the best move is to do nothing. Rebalancing—adjusting your portfolio back to target allocations—should be done methodically, not reactively. It ensures you’re not overexposed to risk without requiring market predictions.

True financial freedom isn’t about hitting a target and stopping. It’s about creating a system that works for you, year after year. This means automating savings, reviewing your plan regularly, and adjusting for life changes without abandoning core principles. It means celebrating progress without getting greedy, and protecting gains without becoming fearful. The most successful investors aren’t gamblers—they’re stewards of their wealth, focused on sustainability over spectacle.

For the 30- to 55-year-old woman managing a household, raising children, and planning for the future, this approach offers something invaluable: control. You don’t need to be a finance expert or follow the markets daily. You just need a clear strategy, a commitment to protection, and the patience to let time work in your favor. Wealth isn’t built in a day, but with the right habits, it can grow steadily and securely. And when you finally reach that place of financial calm—where you can face uncertainty without fear—you’ll realize that the greatest return wasn’t in your portfolio. It was in your peace of mind.