What No One Tells You About Planning Your Honeymoon Budget

Planning a honeymoon should be exciting, not stressful. But when emotions run high and dreams collide with reality, financial blind spots can turn paradise into panic. I learned this the hard way—after nearly overspending on hidden costs and overlooked risks. This isn’t just about picking a destination; it’s about protecting your peace of mind. Let’s walk through the real financial risks behind dream getaways and how to avoid them—without sacrificing joy or breaking the bank.

The Honeymoon Budget Trap: When Love Meets Money

Couples often approach their honeymoon as the ultimate romantic escape, but beneath the surface lies a financial milestone that can shape the early dynamics of married life. Unlike a typical vacation, a honeymoon carries emotional weight and social expectations that can cloud rational decision-making. Many couples feel pressure to make the trip “perfect,” leading to inflated budgets and impulsive choices. The danger isn’t in celebrating love—it’s in treating the honeymoon as a one-time splurge rather than a planned financial event. When excitement overrides caution, even modest-income households can find themselves dipping into emergency savings or accumulating credit card debt.

One of the most common missteps is booking too early without a clear budget. In the glow of engagement, couples may lock in non-refundable deposits for luxury resorts or destination weddings before assessing what they can truly afford. These early commitments can create a financial anchor, forcing other areas of the budget to stretch beyond comfort. Additionally, many underestimate daily expenses abroad—meals, transportation, tips, and local excursions—which can add hundreds of dollars to the trip without feeling like a major purchase in the moment. A $30 dinner here, a $50 boat tour there—it all accumulates invisibly, eroding financial stability.

To avoid this trap, couples should treat the honeymoon like any other major financial goal. This means setting a firm budget before researching destinations, prioritizing value over prestige, and aligning spending with long-term financial health. By reframing the trip as the first joint financial decision of marriage, couples can build trust and communication around money from the start. A well-planned honeymoon doesn’t have to be extravagant to be meaningful—it just needs to reflect thoughtful choices, not emotional impulses. When love and logic work together, the result is not only a memorable trip but a stronger foundation for the future.

Hidden Risks in Paradise: What Travel Brochures Don’t Show

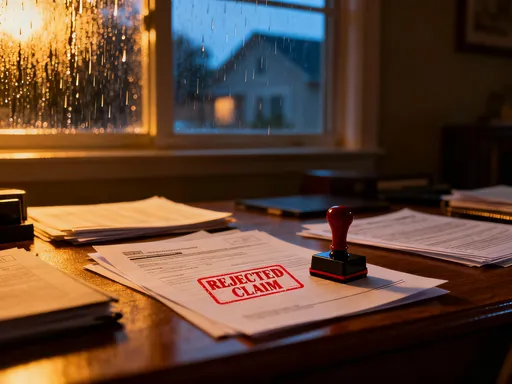

Beneath the glossy images of turquoise waters and white-sand beaches lie financial risks few couples anticipate. Travel brochures sell dreams, but they rarely mention the medical evacuation that could cost tens of thousands of dollars or the sudden storm that cancels flights with no refund. These are not rare occurrences—they are realistic possibilities that can derail both plans and budgets. The first step in protecting your honeymoon investment is acknowledging that risk is not pessimism; it’s preparation. Unexpected events like political unrest, natural disasters, or personal emergencies can disrupt travel at any time, and without safeguards, couples bear the full financial burden.

One of the most overlooked risks is inadequate travel insurance coverage. Many assume their credit card or health insurance provides sufficient protection abroad, but this is often not the case. Standard health plans may not cover medical care in foreign countries, and even basic travel insurance might exclude pre-existing conditions, pregnancy, or high-risk activities like scuba diving or zip-lining. Without proper coverage, a single hospital visit could lead to catastrophic out-of-pocket expenses. Similarly, trip cancellation policies vary widely—some exclude pandemics, while others offer limited reimbursement for partial cancellations. These details matter, and reading the fine print before purchasing is essential.

Other hidden costs include visa fees, airport taxes, and local service charges that aren’t included in initial quotes. Some destinations require proof of onward travel or mandatory health screenings, which can incur additional fees. Currency devaluation in the host country can also reduce purchasing power unexpectedly. For example, a nation experiencing economic instability might see rapid inflation, making meals, transport, and accommodations far more expensive than projected. These factors underscore the importance of researching not just the beauty of a destination, but its financial stability and infrastructure.

The solution lies in proactive risk assessment. Couples should evaluate their destination’s political climate, healthcare system, and travel advisories well in advance. They should also consider the timing of their trip—avoiding hurricane season in the Caribbean or monsoon months in Southeast Asia can prevent costly disruptions. By treating risk management as a core part of planning, couples protect not just their money, but their emotional well-being. A honeymoon should be joyful, not a source of financial anxiety.

Emotional Spending: How Excitement Clouds Judgment

When love and adventure converge, rational financial thinking can take a back seat. The honeymoon phase—both in marriage and in travel—is charged with emotion, making couples more susceptible to impulsive spending. The brain’s reward system lights up with every new experience, from sunset dinners to luxury spa treatments, creating a dopamine loop that justifies indulgence. “It’s our once-in-a-lifetime trip,” becomes the mantra that overrides budget limits. But these small, emotionally driven purchases accumulate quickly, often leading to regret long after the tan has faded.

Emotional spending manifests in many ways. Couples may splurge on overpriced resort packages because they feel entitled to “the best” after months of wedding planning. They might say yes to expensive excursions—private snorkeling tours, helicopter rides, or wine tastings—not because they planned for them, but because the moment feels magical. Gifts for each other, souvenirs for family, and premium dining experiences are often justified as “part of the experience,” even when they blow past allocated budgets. The problem isn’t the spending itself, but the lack of intention behind it.

Psychologically, this behavior stems from a desire to maximize happiness in a fleeting moment. But research shows that while experiences bring joy, financial stress diminishes it. A study by the American Psychological Association found that money-related conflict is one of the leading causes of marital strain. When couples return home to credit card bills they can’t pay, the romance of the trip can be overshadowed by tension and guilt. The emotional high of the honeymoon can thus become a financial low in the weeks that follow.

To counteract this, couples should establish clear spending guidelines before departure. This includes setting daily limits for meals, activities, and discretionary purchases. Using cash envelopes or separate travel debit cards can create psychological boundaries that reduce overspending. Discussing financial priorities in advance—such as whether a private tour is more important than saving for a future home—helps align values and expectations. By separating sentiment from spending, couples can enjoy their trip fully, knowing they won’t pay for it later with stress. True romance isn’t measured by how much you spend, but by how thoughtfully you plan together.

Insurance That Actually Matters: Beyond the Basics

Travel insurance is often treated as an optional add-on, but for honeymooners, it’s a critical financial safeguard. Not all policies are equal, and assuming coverage is comprehensive can lead to devastating gaps in protection. Basic plans may cover flight cancellations due to weather but exclude medical emergencies, evacuation, or trip interruptions caused by personal illness. For couples traveling to remote or developing destinations, this distinction can be the difference between a manageable setback and a financial disaster.

One of the most important considerations is medical coverage abroad. In countries without universal healthcare, even a minor injury or illness can result in exorbitant bills. A sprained ankle requiring X-rays, a stomach infection needing IV treatment, or an allergic reaction could cost thousands without insurance. Emergency medical evacuation—necessary when local facilities are inadequate—can exceed $50,000. Yet many standard travel policies either limit this coverage or exclude it entirely. Couples should look for plans that include robust medical benefits, emergency transport, and 24/7 assistance services.

Another overlooked factor is pregnancy-related complications. Many couples choose tropical destinations for their honeymoons, not realizing that some policies exclude coverage for pregnancy after a certain week, even if the traveler is asymptomatic. Without this protection, an unexpected medical issue could lead to denied claims and out-of-pocket costs. Similarly, adventure activities—popular honeymoon choices like hiking, diving, or ATV tours—are often excluded unless specific riders are purchased. Failing to disclose these activities can void a claim.

To ensure real protection, couples should treat insurance selection like any other major financial decision. This means comparing multiple providers, reading policy documents thoroughly, and asking questions about exclusions and claim processes. It also means integrating insurance into the overall travel fund—viewing the premium not as an expense, but as risk mitigation. For added security, some couples choose to pair travel insurance with a small emergency fund, creating a two-layer defense against the unexpected. When chosen wisely, insurance isn’t a cost—it’s peace of mind.

Currency, Cards, and Cash: Managing Money Across Borders

Navigating foreign currencies can be one of the most confusing—and costly—parts of international travel. Without a clear strategy, couples risk losing hundreds of dollars to hidden fees, poor exchange rates, and insecure payment methods. The way you access money abroad matters just as much as how much you spend. A transaction that seems minor—like withdrawing $100 from an overseas ATM—can come with multiple charges: a foreign transaction fee from your bank, a withdrawal fee from the ATM operator, and an unfavorable exchange rate markup. These layers of cost add up quickly, especially on longer trips.

Credit cards are convenient, but not all are created equal. Many standard cards charge a 3% foreign transaction fee on every purchase, which means a $200 dinner actually costs $206. Over a two-week trip with daily spending, those fees can total hundreds of dollars. The solution is to use a no-foreign-transaction-fee credit card, ideally one that offers travel rewards. These cards not only save money but can earn points toward future travel. However, it’s important to pay off the balance in full each month—carrying a balance negates any savings due to high interest rates.

Prepaid travel cards are another option, allowing couples to load money in advance and lock in exchange rates. While they offer budgeting control and reduce the risk of overspending, they often come with activation fees, reload fees, and limited customer support. Additionally, if the card is lost or stolen, recovering funds can be difficult. Cash is still necessary in many destinations, especially rural areas or small businesses that don’t accept cards. But carrying large amounts poses security risks, and exchanging money at airports or hotels usually offers the worst rates.

The best approach is a balanced one: use a no-fee credit card for major purchases, withdraw cash in larger amounts less frequently to minimize ATM fees, and always check your bank’s international partners for fee-free withdrawals. Inform your bank of travel plans to avoid frozen accounts due to “suspicious activity.” Keep a backup card and some emergency cash in a separate location. With smart planning, currency management becomes a seamless part of the journey—not a source of stress.

Flexibility as Financial Armor: Why Rigid Plans Fail

In the world of travel, inflexibility is the enemy of financial control. Couples who lock in every detail months in advance may believe they’re being responsible, but they’re often limiting their ability to adapt. Life happens—flights get delayed, weather disrupts itineraries, and personal circumstances change. When plans are too rigid, even minor disruptions can trigger financial losses. Non-refundable bookings, fixed-date tours, and inflexible return flights leave little room for adjustment, forcing couples to absorb costs they could have avoided.

The smarter strategy is to build flexibility into the budget and itinerary. This means prioritizing refundable or changeable bookings, even if they cost slightly more upfront. The extra expense is often offset by the ability to rebook during disruptions without penalty. Similarly, choosing travel dates during shoulder seasons—just before or after peak times—can reduce costs significantly while offering better availability for changes. A flight in late April to Europe, for example, can be 30% cheaper than one in mid-June, with fewer crowds and more accommodation options.

Flexibility also applies to destinations. Instead of fixating on one location, couples can identify multiple options with similar appeal but different price points. If one becomes unexpectedly expensive due to currency shifts or demand spikes, they can pivot without starting from scratch. Open-jaw flights (flying into one city and out of another) and multi-city itineraries can also increase options and reduce backtracking costs. These strategies don’t diminish the experience—they enhance resilience.

Time is another form of financial protection. Allowing extra days in the schedule creates buffer zones for delays or spontaneous opportunities. It also reduces the pressure to “see everything,” which often leads to overspending on tours and transportation. A slower pace means lower daily costs and more meaningful experiences. By embracing flexibility, couples gain control, not lose it. They trade the illusion of certainty for real financial security, ensuring that surprises don’t become setbacks.

Building a Travel Fund That Protects Your Future

The honeymoon is not an isolated expense—it’s the beginning of a lifetime of shared financial decisions. How couples manage this first major joint purchase sets a precedent for future goals, from buying a home to saving for children. Instead of treating the trip as a one-time splurge, forward-thinking couples view it as the launch of a travel fund—a dedicated savings pool that evolves with their lives. This fund doesn’t disappear after the honeymoon; it becomes a tool for future adventures, emergency reserves, or even retirement travel.

Creating a travel fund starts with intention. Couples set a target amount, break it into monthly contributions, and automate transfers to a separate account. This method builds discipline and reduces the temptation to dip into other savings. Over time, the fund grows, not just in balance but in purpose. It becomes a symbol of teamwork, a shared goal achieved through consistency and communication. When both partners are involved in tracking progress and making decisions, trust deepens.

Moreover, the skills learned during honeymoon planning—budgeting, risk assessment, spending discipline—translate directly to broader financial health. The same awareness that prevents overspending on souvenirs can help avoid impulse purchases at home. The habit of comparing insurance options can improve decisions about health or auto coverage. The practice of building a buffer applies to emergency funds and investment strategies. In this way, the honeymoon becomes more than a trip—it becomes financial training for marriage.

Ultimately, the most romantic thing couples can do is align their financial lives. A marriage built on transparency, mutual respect, and shared goals is far more valuable than any luxury resort. By planning the honeymoon with care, couples don’t just protect their budget—they invest in a future where love and financial stability go hand in hand. The journey begins with a single step, but its impact lasts a lifetime.